My Vision in Acquisition Entrepreneurship

My personal vision for ETA: where I see myself in the future and the path I’m taking to get there.

I’m glad you’ve been following along with my first two newsletter broadcasts.

Over the past few weeks, I’ve shared conversations with others in the ETA space and reflected on their journeys. But today I want to pause, take a step back, and write about something more personal: my own vision.

For me, entrepreneurship through acquisition is not just about numbers, legal models, or financial structures. It’s about designing a life, building something lasting, and stepping into ownership in a way that reflects my values.

I am still at the beginning of this journey. I am not yet a full-time acquirer. I continue to work as a startup mentor and coach, and I write this newsletter, conduct my research, and explore opportunities in my free time. That context matters because it means what you’re reading here is a vision in motion, not a polished end state.

But clarity comes from writing things down. So today I want to share, in depth, how I see myself in the world of ETA: the kind of businesses that attract me, the models that fit me, the regions where I want to operate, and the partners I’m hoping to meet along the way.

Why ETA? My Motivation

When I look at the entrepreneurial landscape, I see three main paths: building something from scratch, climbing the corporate ladder, or acquiring an existing business. I’ve tasted elements of the first two, but neither fully resonates with me.

Starting from scratch is exciting, but also slow, fragile, and often wasteful. It can take years to build a foundation, and many never reach stability. Corporate life, on the other hand, provides structure and security, but often at the cost of autonomy, ownership, and real impact.

ETA strikes me as a third way. It allows me to step into ownership of something real, with employees, customers, and history already in place. It means becoming a steward of a business that matters to its community. It means continuity and renewal, not constant reinvention.

And most of all, ETA excites me because it allows me to combine long-term building with personal autonomy. I can craft not just a company, but a portfolio and eventually a legacy.

Where I Am Right Now

It’s important to be transparent. I’m not yet running my own HoldCo (although I still have one from my earlier startup-building days) or search fund. I’m still working full-time as a startup mentor and coach. Although my work with founders keeps me close to the world of entrepreneurship, I pursue my acquisition journey in the evenings, at weekends and during any other free moments I can find.

That means Buyout Diary is a double act: it is my own preparation process, but it’s also my way of sharing openly with others who might be in a similar position. I know many of my readers are also early in their journey, learning about ETA alongside their day jobs. If that’s you, then I want you to know that you’re not alone.

How I See Myself in ETA Models

One of the first questions people ask in ETA is: which model do you want to follow? And it’s a good question, because the model shapes everything: your financing, your governance, your time horizon, even your role as an entrepreneur.

The traditional search fund is well established in the United States: investors back a full-time searcher, who finds and acquires a business, then often sells within five to seven years. I respect this model, but I don’t feel it fits my personal style. I’m not driven by the idea of a quick exit (though I know some searchers also follow a long-term approach within this framework).

Self-funded acquisitions offer autonomy and flexibility, but they are risky, highly personal, and often lonely.

The independent sponsor model, which involves raising capital on a deal-by-deal basis, is becoming increasingly popular in Europe. While they require strong, trust-based networks, they also allow for greater flexibility. 👉 I’ve written more about this approach in a separate piece: Independent Sponsors: ETA’s Best-Kept Secret?

HoldCos are what resonate with me most. These are holding companies that own multiple businesses long term. Their approach of buying, holding and growing over decades rather than years aligns with my own thinking. 👉 If you’d like a simple breakdown of how the ETA models differ, I’ve explained it in The Three ETA Models Explained

Where do I see myself? Somewhere between a HoldCo and an independent sponsor. I imagine starting with deal-by-deal acquisitions, especially in fragmented sectors where a roll-up makes sense, and gradually building into a multi-company HoldCo with a long-term outlook.

My Business Philosophy

The type of business you buy matters just as much as how you buy it. My philosophy is shaped by a few simple beliefs:

I believe in Handwerk → craftsmanship businesses. These are trades and services where skilled labour is essential, where trust and reputation matter, and where automation and AI can’t easily disrupt the model. Think HVAC, roofing, truck repair, or other skilled trades.

I believe in businesses that serve recurring, practical demand. Companies that communities and other businesses depend on.

I believe in stability over glamour. I am not looking for the next big trend. I’d rather own something unsexy but resilient.

On the other hand, I tend to avoid:

Businesses that rely on fragile, fast-changing trends.

Ventures exposed to sudden technological disruption.

Models that don’t lend themselves to delegation or long-term ownership.

Why this fits me: I value reliability, resilience, and the chance to build over the long term. I’m not here to flip or chase hype; I want to hold, grow, and steward.

Where I Want to Operate

Geographically, my focus is clear: Germany and the Netherlands, with an openness to parts of Central and Northern Europe.

Why here? Because it’s where I have cultural fit, language skills, personal networks, and family life. But also because this region faces one of the biggest succession challenges in the world. Thousands of SMEs will need new owners in the next decade. Many have no clear succession plan. That is both a challenge and an opportunity.

👉 I recently shared some thoughts on this challenge in Why the Succession Gap is a Goldmine for First-Time Buyers

The European ETA landscape is more fragmented than that of the United States. Support structures are in place, but these vary by country and, in some cases, even by province (as is the case in Germany). This makes the process more complex, localised and relationship-driven.

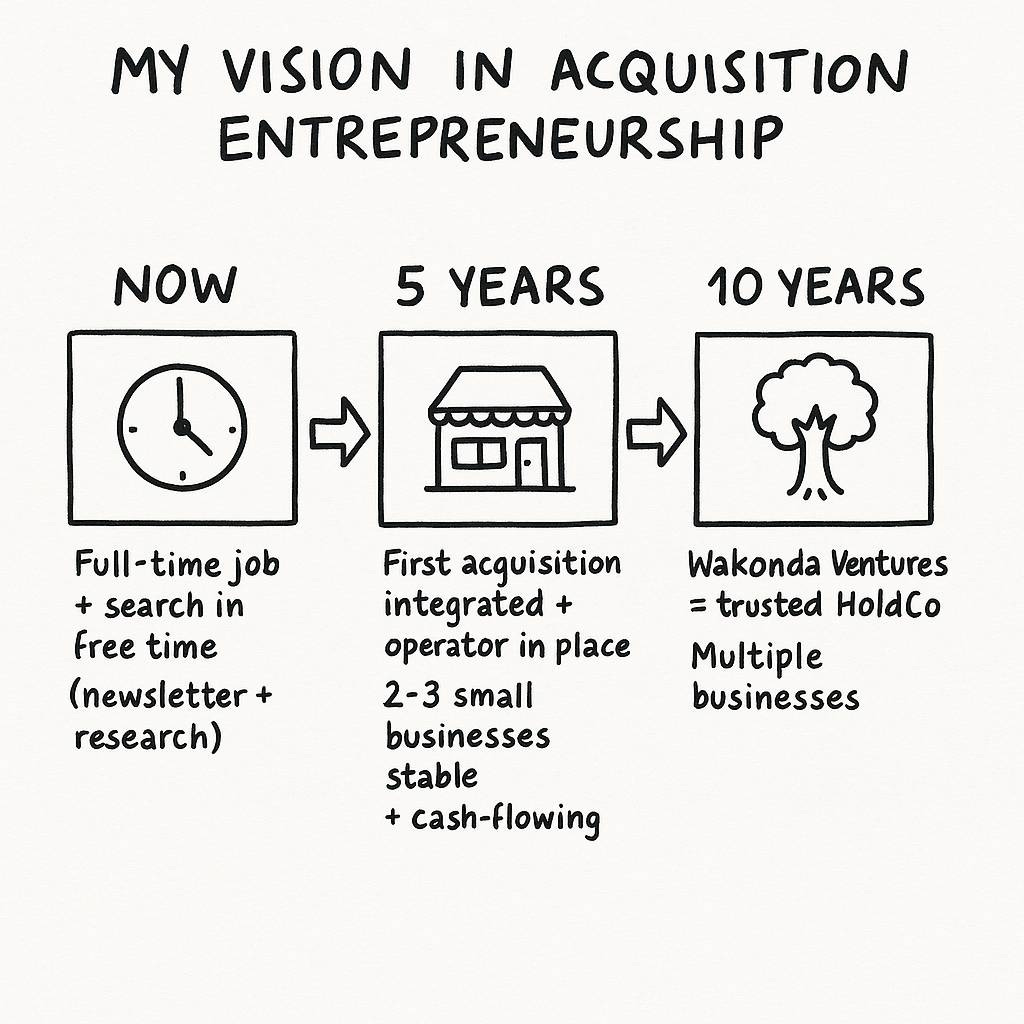

Looking Ahead: My 5-Year and 10-Year Horizons

What does this vision look like in practice? I try to imagine it in two stages:

In five years’ time: I want to have completed my first acquisition, integrated it successfully and put the right operator in place. Ideally, I would like to own a small portfolio of two or three stable, delegable businesses with a good cash flow.

In ten years’ time: I want Wakonda Ventures to be recognised as a trusted HoldCo. I see it owning a mix of craftsmanship/service businesses and digital ventures (through dourovista). I want it to be known for strong governance, steady cash flows, and long-term stewardship. Not a private equity firm chasing exits, but an owner with patience and purpose.

Building the Ecosystem Around My Vision

My vision is not only about buying businesses. It’s about building an ecosystem around ETA:

Buyout Diary is my public journal, where I document my thoughts and share the lessons I have learned, with the aim of creating transparency.

dourovista is digital venture arm focuses on content, education, and assets in the creator economy, with Buyout Diary being the first example. These complement my HoldCo.

The Amsterdam ETA Community (Meetup): a space for aspiring and active acquirers to meet, learn, and support one another. You can find the group here 👉 ETA Amsterdam

And here is something important: I don’t want this to be only about me. I want it to help others. ETA can feel lonely, especially in Europe, where the ecosystem is younger. With my newsletter and my community, I hope to make ETA more visible, more accessible, and more supportive for those who want to follow this path.

Why I Won’t Do This Alone

Another truth: ETA is not a solo sport. It can be, but I don’t want it to be.

I am not looking for fast capital or opportunistic flips. I am looking for people who share a long-term vision of ownership. That means surrounding myself with:

Investors who are patient, comfortable with SMEs, and open to deal-by-deal partnerships in Europe.

Operators and CEOs who can lead businesses day-to-day with integrity and long-term thinking.

Advisors and board members who can provide governance, accountability, and wisdom.

Peers and community members who are willing to share lessons, failures, and encouragement.

This is not about building alone. It’s about building together.

Who I’m Looking For

To be specific, here are the partners I imagine on this journey:

Investors: patient capital aligned with a buy-and-hold philosophy, open to deal-by-deal roll-up strategies.

Entrepreneurial partners: co-investors or operators who want to build something bigger than a single deal.

Future team members: fractional CFOs, advisors, or general managers who can grow into leadership.

Community peers: not just financiers, but people who believe in relationships, integrity, and shared vision.

Closing Reflection

As I write this, I am aware that my vision may seem overly ambitious to some. A HoldCo, a roll-up, a digital sub-HoldCo, a newsletter, a community… it’s a lot.

But I like big visions. They stretch me. They force me to grow into them.

And I want to underline one thing: I’m not only doing this for myself. Through Buyout Diary and the Amsterdam community, I want to help others step into ETA, share the lessons I learn, and create a network that makes acquisition entrepreneurship more accessible.

Right now, I’m still working full-time, preparing in the margins of my days. But by sharing this vision, I make it real. And by sharing it with you, I make myself accountable.

This is where I stand today. The vision will evolve, but the direction is clear. And I’m glad you’re here to follow along.

I’d now love to hear from you. What is your vision? Where do you see yourself in five or ten years’ time? What kind of business or business model are you interested in?

Hit reply. Tell me your story. I’d be genuinely interested to read your thoughts.

Warm regards,

Alexander